Beyond The Debt-For-Diploma System

Beyond the Debt-For-Diploma System: 10 Ways Student Debt Is Blocking the Economic Mobility of Young Americans.

America’s experiment with the debt-for-diploma system has officially failed. Total student loan debt in the U.S. now tops $1 trillion—an unprecedented sum that represents the unprecedented obstacles students and recent graduates face in their pursuit of the American Dream.

Over the last several decades, our nation slowly and steadily shifted the burden of paying for college from a public responsibility to a private one, leaving most students with debt and leaving many potential students behind. As state funding declined and tuition at state universities rose in response, federal financial aid has shifted from making college affordable through grants to lower income students to providing loans that simply help families finance a college degree.

It’s time to renew our commitment to an accessible and affordable higher education system in the United States. Debt is not financial aid—it allows students to pay for college but also raises the cost of a degree because all student loans, especially private loans, include interest charges and origination fees. The need for student loans has also created a very lucrative market for the private lenders and banks who, until 2010, profited from guarantees through the federal student loan system and who are benefiting today from the demand for financing beyond the federal loan program.

As activists across the country protest the debt-for-diploma system and its $1 trillion mark, below are the top 10 reasons why our nation must embark on a new strategy to make college affordable as opposed to merely financeable through student loans.

America Shortchanges Higher Education

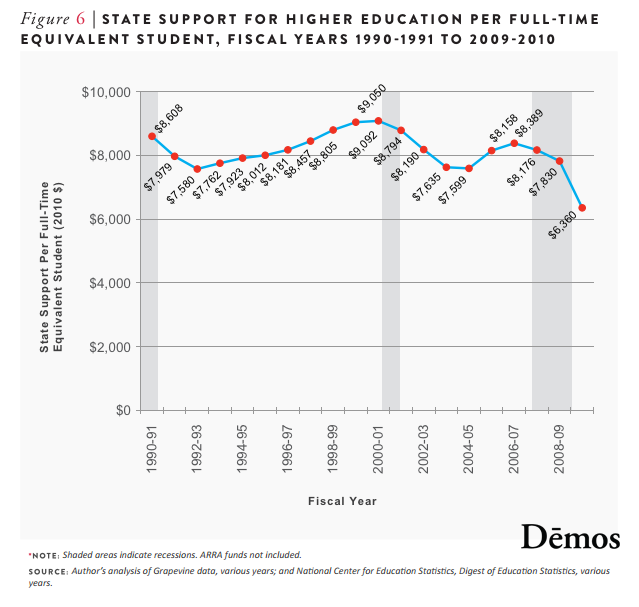

1.) From 1990 to 2010, state funding for public higher education fell 26.1 percent per full-time equivalent student, a major driver of rapidly rising tuition rates. Over the past 20 years there has been a breakdown in the historical funding pattern of recessionary cuts and expansionary rebounds. The length of time for higher education funding to recover following recessions has lengthened for every downturn since 1979 with early evidence suggesting that the recovery from the Great Recession will be no different.

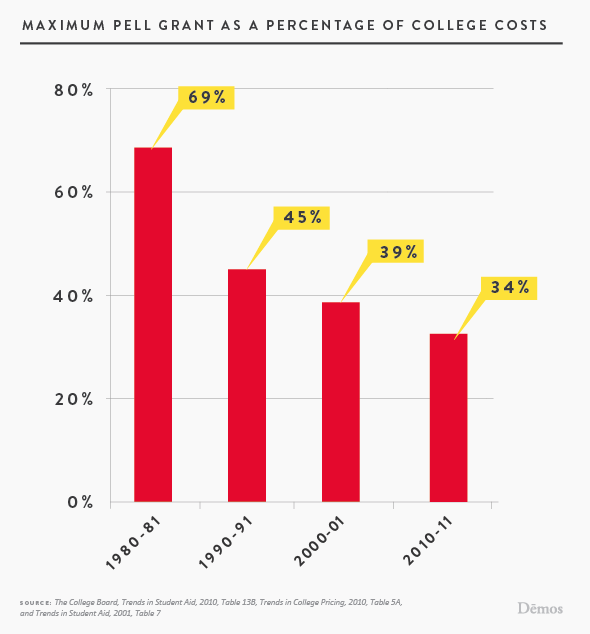

2.) In 1980, 39 percent of federal financial aid to undergraduates was in the form of loans, and 55 percent was awarded in grants. By 2008, this had shifted to 64 percent of the funds awarded as loans and only 26 percent as grants. Moreover, today’s maximum Pell Grant covers just over a third of the costs of attending a public 4-year university, down from over two-thirds in 1980.

3.) A lack of public investment has resulted in tuition more than tripling at public 4-year universities between 1980 and 2010.

Click here to read the entire report.

Author Information

|

DemosPosted on 19 December 2013 |

| Demos is a public policy organization working for an America where we all have an equal say in our democracy and an equal chance in our economy. Their name means “the people.” It is the root word of democracy, and it reminds us that in America, the true source of our greatness is the diversity… | |

| Visit Website | Follow @Demos_Org |